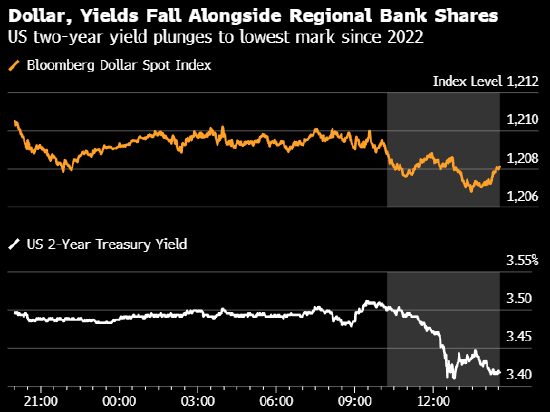

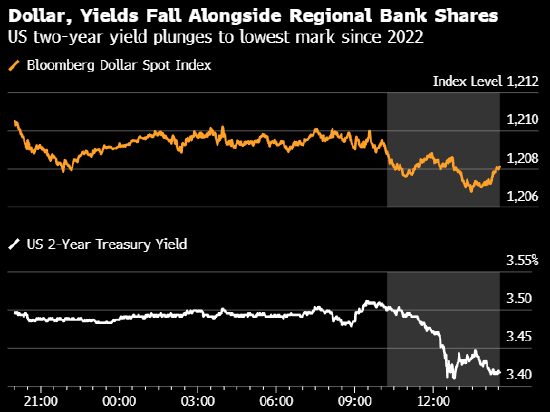

美国银行股抛售刺激避险资产需求后,美国国债价格全面上涨,导致彭博美元指数下跌。日元和瑞士法郎在 G-10 货币中处于领先地位。

自亚洲时段开盘以来一直承压的彭博美元现货指数下跌0.3%,触及日内低点,连续第三个交易日走低。

锡安银行(Zion Bank)和西部联盟银行(Western Alliance Bancorp)透露,他们发放的贷款存在欺诈行为,引发信贷市场担忧,导致股价暴跌,拖累银行业。

两年期美国国债收益率下跌近9个基点至3.41%,为2022年9月以来的最低水平。

KBW地区银行指数一度下跌5.8%,创8月1日以来盘中最低水平。

此前,美联储理事克里斯托弗·沃勒表示,美联储可能继续降息25个基点;美联储理事斯蒂芬·米兰重申ed his view on another occasion that interest rates could be cut by 50 basis points this month.

The Philadelphia Fed Manufacturing Index unexpectedly fell to -12.8 in October, while economists expected 10.

EUR/USD rose 0.4% to an intraday high of $1.1694, the highest level since October 7.

French Prime Minister Sebastian Le Corni survived two no-confidence votes on Thursday, paving the way for a budget debate.

The Japanese yen led G-10 gains against the US dollar,with USD/JPY falling 0.5% to 150.36;美元/瑞郎下跌 0.4% 至 0.7936。

Traders said that after USD/JPY fell below 150.60 twice before, there is strong demand in the onshore market, indicating that option-related buying is in the works.

SANAE's chances of becoming Japan's next prime minister depend on the outcome of policy negotiations between the liberal Democratic Party of Japan and the reform council.

澳元/美元下跌 0.5% 至 0.6479。

Businessmen had earlier raised expectations for a rate cut from the country's centr数据显示澳大利亚失业率创四年新高后,美国银行表示。

新浪财经公众号

24小时播放最新财经新闻和视频。更多粉丝福利,扫描二维码关注(新浪财经)

美国银行股抛售刺激避险资产需求后,美国国债价格全面上涨,导致彭博美元指数下跌。日元和瑞士法郎在 G-10 货币中处于领先地位。

自亚洲时段开盘以来一直承压的彭博美元现货指数下跌0.3%,触及日内低点,连续第三个交易日走低。

锡安银行(Zion Bank)和西部联盟银行(Western Alliance Bancorp)透露,他们发放的贷款存在欺诈行为,引发信贷市场担忧,导致股价暴跌,拖累银行业。

两年期美国国债收益率下跌近9个基点至3.41%,为2022年9月以来的最低水平。

KBW地区银行指数一度下跌5.8%,创8月1日以来盘中最低水平。

此前,美联储理事克里斯托弗·沃勒表示,美联储可能继续降息25个基点;美联储理事斯蒂芬·米兰重申ed his view on another occasion that interest rates could be cut by 50 basis points this month.

The Philadelphia Fed Manufacturing Index unexpectedly fell to -12.8 in October, while economists expected 10.

EUR/USD rose 0.4% to an intraday high of $1.1694, the highest level since October 7.

French Prime Minister Sebastian Le Corni survived two no-confidence votes on Thursday, paving the way for a budget debate.

The Japanese yen led G-10 gains against the US dollar,with USD/JPY falling 0.5% to 150.36;美元/瑞郎下跌 0.4% 至 0.7936。

Traders said that after USD/JPY fell below 150.60 twice before, there is strong demand in the onshore market, indicating that option-related buying is in the works.

SANAE's chances of becoming Japan's next prime minister depend on the outcome of policy negotiations between the liberal Democratic Party of Japan and the reform council.

澳元/美元下跌 0.5% 至 0.6479。

Businessmen had earlier raised expectations for a rate cut from the country's centr数据显示澳大利亚失业率创四年新高后,美国银行表示。

新浪财经公众号

24小时播放最新财经新闻和视频。更多粉丝福利,扫描二维码关注(新浪财经)

美国银行股抛售刺激避险资产需求后,美国国债价格全面上涨,导致彭博美元指数下跌。日元和瑞士法郎在 G-10 货币中处于领先地位。

自亚洲时段开盘以来一直承压的彭博美元现货指数下跌0.3%,触及日内低点,连续第三个交易日走低。

锡安银行(Zion Bank)和西部联盟银行(Western Alliance Bancorp)透露,他们发放的贷款存在欺诈行为,引发信贷市场担忧,导致股价暴跌,拖累银行业。

两年期美国国债收益率下跌近9个基点至3.41%,为2022年9月以来的最低水平。

KBW地区银行指数一度下跌5.8%,创8月1日以来盘中最低水平。

此前,美联储理事克里斯托弗·沃勒表示,美联储可能继续降息25个基点;美联储理事斯蒂芬·米兰重申ed his view on another occasion that interest rates could be cut by 50 basis points this month.

The Philadelphia Fed Manufacturing Index unexpectedly fell to -12.8 in October, while economists expected 10.

EUR/USD rose 0.4% to an intraday high of $1.1694, the highest level since October 7.

French Prime Minister Sebastian Le Corni survived two no-confidence votes on Thursday, paving the way for a budget debate.

The Japanese yen led G-10 gains against the US dollar,with USD/JPY falling 0.5% to 150.36;美元/瑞郎下跌 0.4% 至 0.7936。

Traders said that after USD/JPY fell below 150.60 twice before, there is strong demand in the onshore market, indicating that option-related buying is in the works.

SANAE's chances of becoming Japan's next prime minister depend on the outcome of policy negotiations between the liberal Democratic Party of Japan and the reform council.

澳元/美元下跌 0.5% 至 0.6479。

Businessmen had earlier raised expectations for a rate cut from the country's centr数据显示澳大利亚失业率创四年新高后,美国银行表示。

新浪财经公众号

24小时播放最新财经新闻和视频。更多粉丝福利,扫描二维码关注(新浪财经)

美国银行股抛售刺激避险资产需求后,美国国债价格全面上涨,导致彭博美元指数下跌。日元和瑞士法郎在 G-10 货币中处于领先地位。

自亚洲时段开盘以来一直承压的彭博美元现货指数下跌0.3%,触及日内低点,连续第三个交易日走低。

锡安银行(Zion Bank)和西部联盟银行(Western Alliance Bancorp)透露,他们发放的贷款存在欺诈行为,引发信贷市场担忧,导致股价暴跌,拖累银行业。

两年期美国国债收益率下跌近9个基点至3.41%,为2022年9月以来的最低水平。

KBW地区银行指数一度下跌5.8%,创8月1日以来盘中最低水平。

此前,美联储理事克里斯托弗·沃勒表示,美联储可能继续降息25个基点;美联储理事斯蒂芬·米兰重申ed his view on another occasion that interest rates could be cut by 50 basis points this month.

The Philadelphia Fed Manufacturing Index unexpectedly fell to -12.8 in October, while economists expected 10.

EUR/USD rose 0.4% to an intraday high of $1.1694, the highest level since October 7.

French Prime Minister Sebastian Le Corni survived two no-confidence votes on Thursday, paving the way for a budget debate.

The Japanese yen led G-10 gains against the US dollar,with USD/JPY falling 0.5% to 150.36;美元/瑞郎下跌 0.4% 至 0.7936。

Traders said that after USD/JPY fell below 150.60 twice before, there is strong demand in the onshore market, indicating that option-related buying is in the works.

SANAE's chances of becoming Japan's next prime minister depend on the outcome of policy negotiations between the liberal Democratic Party of Japan and the reform council.

澳元/美元下跌 0.5% 至 0.6479。

Businessmen had earlier raised expectations for a rate cut from the country's centr数据显示澳大利亚失业率创四年新高后,美国银行表示。

新浪财经公众号

24小时播放最新财经新闻和视频。更多粉丝福利,扫描二维码关注(新浪财经)